CSUSOP Should Review IRS's Error-!

CSUSOP stands for the Commission of the State of U.S. Olympics and Paralympics.

The Empowering Olympic, Paralympic, and Amateur Athletes Act of 2020 requires the CSUSOP to assess the finances and the financial organization of the United States Olympic and Paralympic Committee (USOPC.)

The CSUSOP completed its work on September 30 and will deliver a report to Congress in Spring 2024. However, I am requesting the CSUSOP at the last minute to review the error (or typo error) made by the Internal Revenue Service (IRS), which I discovered last Friday.

Currently, the acronym of the U.S. Open Cup is USOC. The Cup is a knockout cup competition in men's soccer (globally as football) in the United States of America. You may recall that the Inter Miami soccer team signed Superstar Lionel Messi last July.

What is the IRS’s error?

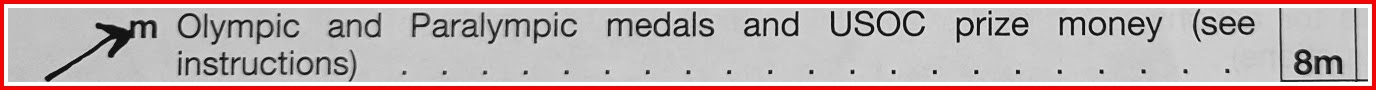

Click 2022 Schedule 1 (Form 1040) and scroll down to “m” (shown below picture.)

Does it sound like a Lamar Hunt U.S. Open Cup participant earns this prize money?

Nay, the IRS should replace it with “USOPC.”

In October 2016, President Barrack Obama signed the United States Appreciation for Olympians and Paralympians Act into law, which amended the Internal Revenue Code of 1986 to exclude from gross income any prizes or awards won in competition in the Olympic Games or the Paralympic Games.

The United States Olympic Committee Board changed its name to the USOPC on June 20, 2019.

Two years later, in late 2021, the IRS did not notice the change before processing the 2022 returns on January 24, 2022.

Will the CSUSOP disclose the IRS mistake in its final report to Congress next year?

Inspired by the federal 2016 Act, Maryland Delegate Mary Ann Lisanti testified on January 19, 2017, before the Ways and Means Committee about her sponsored bill, HB003/2017, that would exempt from the state and local income tax the value of specified medals and prize money or honoraria received by an individual who competes in the Olympic Games or the Paralympic Games.

After listening to my testimony urging the committee to include the Deaflympics, Del. Lisanti made a quick amendment to her bill by adding the Deaflympics and Special Olympics. Gov. Larry Hogan quickly signed it into law, Chapter 501 of the Acts of 2017.

No media, including USOPC, picked up this vital news.

Maryland is one of four states with similar income tax deductions for Olympic medalists. The other states are Pennsylvania, Virginia, and Wisconsin.

However, Maryland is the only state that allows a deduction for medals and monetary awards from any Special Olympic or Deaflympic Games, in addition to prize money from the USOPC.

The last two paragraphs are mentioned in Colorado’s “Olympic Medalist Income Tax Deduction.”

Read more about my fight for equity for Maryland’s Deaf at MarylandMatters.org.

On behalf of our forgotten USA Deaflympians, I am urging that the CSUSOP will recommend Congress to add the Deaflympics and Special Olympics to the United States Appreciation for Olympians and Paralympians Act.